What is WhānauSaver?

How does it work?

How is it different to Kiwisaver?

When can I withdraw my savings?

Fees and more information

Do I have to be registered with my Iwi to sign up for WhānauSaver?

Who is SuperLife?

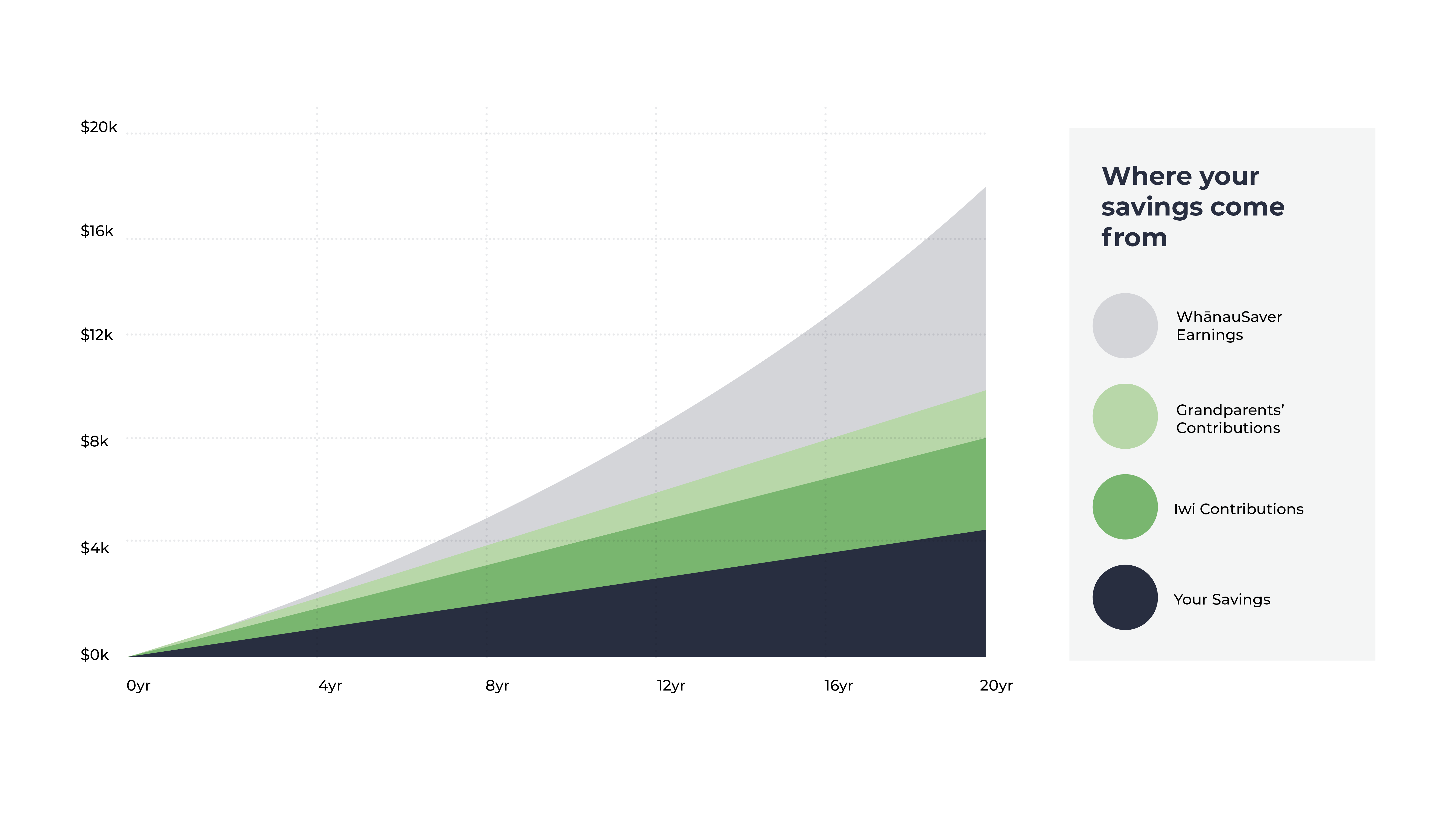

WhānauSaver is a powerful way to invest in your financial future and the future of your tamariki. Accounts can be set up from birth and can be contributed to by your wider whānau, including grandparents and your iwi – which over time can grow to create a financial nest egg for retirement, education, housing or financial emergencies.

WhānauSaver has been designed by Te Kotahitanga o Te Atiawa and Te Kāhui o Taranaki in conjunction with SuperLife

- WhānauSaver is delivered by Smartshares through SuperLife, using its registered SuperLife Invest and SuperLife KiwiSaver schemes. Smartshares is a proud partner of Ka Uruora as the provider of WhānauSaver, a savings programme with special features and benefits to help whānau achieve their financial goals.

- Smartshares Limited is the manager of the SuperLife Invest and SuperLife KiwiSaver Schemes. The product disclosure statement is available at www.superlife.co.nz

Joining

- Available exclusively to registered members of all participating iwi.

- You can join from any age (including newborns)

- Parents, grandparents and wider whānau can apply for children

Making contributions

- You decide how much you save – you can contribute any value at any time

- Set up an automatic payment or make electronic transfers directly into your account

- You can also make contributions directly into the account of your tamariki, mokopuna or wider whānau

Iwi contributions

- Each year your Iwi will let you know how much it will contribute to your savings. As an example, in the past Iwi have matched dollar for dollar up to $100 meaning that if you have contributed just $2 per week, you will have $204 after your Iwi contribution. This includes $104 personal contributions and $100 contributions. Your Iwi will match any contributions regardless of who made them.

- Your iwi contributions will include Maori Authority Tax Credits, available for members to offset against tax payable on their taxable income – see more

Investment choices

For more information on WhanauSaver read the product disclosure statement.

WhānauSaver is intended to complement your KiwiSaver account.

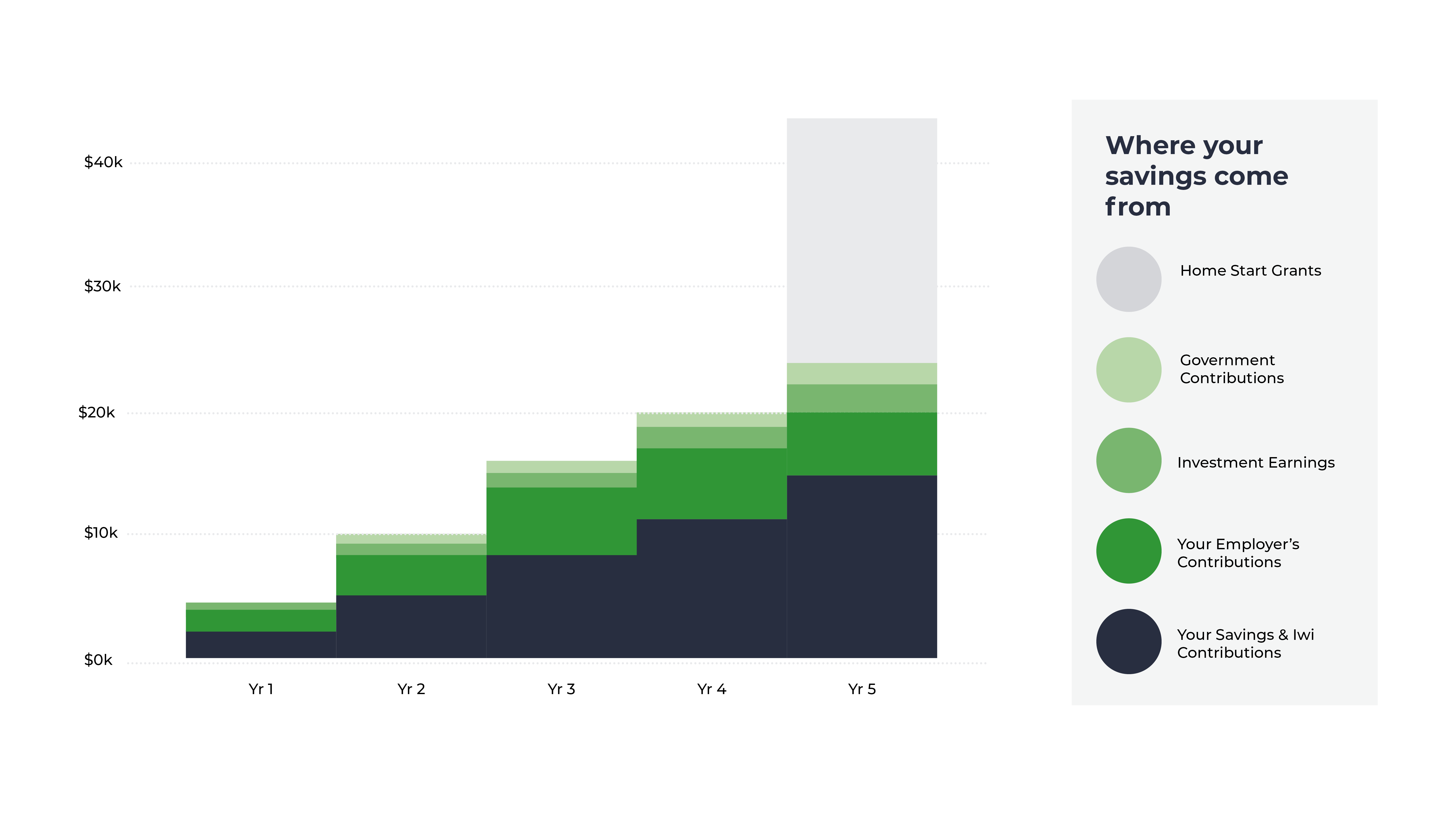

Kiwisaver

- The Government makes a contribution (up to $521 per year) – see more

- Your contributions are automatically deposited by your employer (a percentage of your income)

- Your Employer makes contributions (3% of your income) – see more

- You can use KiwiSaver to apply for the HomeStart grant (up to $10,000) – see more

- KiwiSaver can be withdrawn when you purchase your own home or at age 65

WhānauSaver

- You make deposits when you like and at the amount you choose.

- Your Iwi will make annual contributions.

- WhānauSaver can be withdrawn for tertiary education, your first home, financial emergencies or at age 55

For more information on WhanauSaver read the product disclosure statement.

- Short-term emergencies

You can make an early withdrawal for a short-term emergency (up to $500 a year).

- Tertiary education

Use your savings to finance your studies in an NZQA equivalent course – Tertiary Education Withdrawal policy

- First home

Use your savings to help buy your first home – the same withdrawal rules apply to those for KiwiSaver – see more.

- Retirement

Access your savings from age 55.

- Death, serious illness or significant financial hardship

Similar to KiwiSaver, you can also access your savings when in these circumstances.

For more information on WhanauSaver read the product disclosure statement.

Fees

- An admin fee of $12 pa ($1 / month) + fund charges of 0.46% – 0.6% per year depending on which investment strategy you choose.

- You can read the full rules and product disclosure statement here

More information

- For more information on Ka Uruora WhānauSaver, please refer to the Product Disclosure Statement

- You can get in touch with us at any time if you have any questions. Get in touch using the form on our contact page, here or email tewaka@kauruora.nz

Yes.

You must be a registered member of one or more of the eligible participating Iwi.

If you are a member of more than one of the eligible Iwi, you could receive multiple contributions to your WhānauSaver – there’s never been a better time to ensure you’re registered with all the iwi that you whakapapa to.

Currently, Taranaki and Te Atiawa are the two eligible Iwi, but more are on the way. If your Iwi isn’t a participating Iwi partner, get in touch with your Iwi Trust Board and ask them to enquire about joining.

Register with your eligible Iwi now

Taranaki

Te Atiawa

Superlife

For more than 20 years SuperLife has been caring for and nurturing the financial wellbeing of New Zealanders. The programme is delivered by Smartshares through SuperLife, using its registered SuperLife Invest and SuperLife KiwiSaver schemes.

- Smartshares is a proud partner of Ka Uruora as the provider of WhanauSaver, a savings programme with special features and benefits to help whanau achieve their financial goals.

- Smartshares Limited is the manager of the SuperLife Invest and SuperLife KiwiSaver Schemes. The product disclosure statement is available at www.superlife.co.nz

A passive investment philosophy

SuperLife believes that a passive approach to investing will deliver better long-term results. Passive investing means SuperLife will either invest in a fund designed to track an index or in a number of assets for the long term. SuperLife do not think that constantly changing investments (that is, trading regularly and seeking short-term gains), consistently adds value to investors.

Low fees

- Our fees are among the lowest in the market. We don’t charge performance-based fees or commissions.

- Fees matter. The impact of even small fee differences each year can be significant over time.

- We make decisions based on what is practical, sensible and for the long term. All decisions must be cost-effective – the return to you is improved by the careful management of costs

Flexibility

- Your money is invested with SuperLife giving you the choice of six funds that could help grow your savings even faster.

- You can set and change their investment strategies at any time, free of charge.

Transparency

- This means being honest about what we can and can’t do for you.

- We will always quote investment returns after (net of) total fund charges and taxes. This is because we believe this information is more useful for you.

Exceptional customer service

- We are focused on providing you with information to help you make informed decisions. This does not include personalised financial advice.

Smartshares Limited is the manager of the SuperLife Managed Investment Schemes. The product disclosure statements are available at www.superlife.co.nz